The New Thinking on KPIs, part 3 of 4

The four types of performance measures

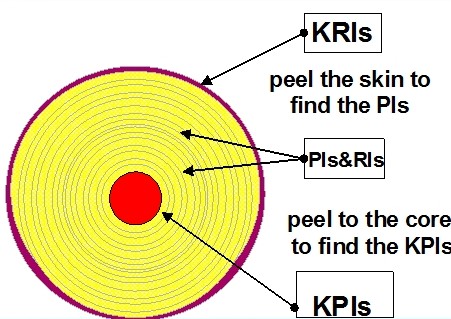

I have come to the conclusion that there are four types of performance measures, as shown in Figure 3. This conclusion has come from: the research I have conducted; workshop feedback across diverse industries; and as a by-product of writing my book “Key Performance Indicators – developing, implementing and using winning KPIs”.

Figure 3: A scorecard with six perspectives

- key result indicators (KRIs) – give an overview on past performance and are ideal for the Board as they communicate how management have done in a critical success factor or balanced scorecard perspective

- performance indicators (PIs) – tell staff and management what to do

- result indicators (RIs) – tell staff what they have done

- key performance indicators (KPIs) – tell staff and management what to do to increase performance dramatically.

Hi there! This article is available for free. Simply register as a StrategyDriven Personal Business Advisor Self-Guided client by clicking here.

Already a client? Login to access this article.

About the Author

and Pareto’s 80/20 Rule for Corporate Accountants

, is an international presenter who is known for his thought provoking and lively sessions, which have led to substantial change in many organizations. He is a leading expert in developing winning KPIs, replacing the annual planning process with quarterly rolling planning, accelerating month-end processes, and converting reporting to a decision based tool.

David’s work on KPIs has received international recognition with clients in Auckland, Wellington, Sydney, Melbourne, Brisbane, Adelaide, Canberra, Perth, Kuala Lumpur, Singapore, Tehran, Prague, Dublin, London, Birmingham, Manchester and Edinburgh. David is a fellow of the Institute of Chartered Accountants in England & Wales and has worked for Ernst & Young, BP Oil Ltd, Arthur Andersen, and Price Waterhouse Coopers.

David’s recent thinking is accessible from www.davidparmenter.com. He can be contacted at [email protected] or telephone +64 4 499 0007.

This articles is an extract from his “Implementing winning KPIs” whitepaper which can be downloaded from http://davidparmenter.com/how-to-guides)

Leave a Reply

Want to join the discussion?Feel free to contribute!