StrategyDriven Editorial Perspective – How to Respond to the Government’s Takeover of the Economy

- U.S. Financial Industry – representing approximately 33 percent of the U.S. marketplace, the U.S. Government gained control through the Troubled Asset Relief Program (TARP) and separate bailouts of mortgage giants Fannie Mae and Freddie Mac.

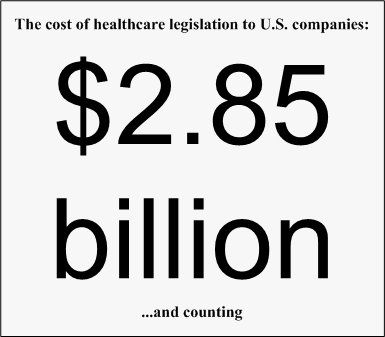

- U.S. Healthcare Industry – representing approximately 17 percent of the U.S. marketplace, the U.S. Government gained control through the passage of healthcare legislation in March 2010.

- Other Major U.S. Businesses – representing approximately 1 percent of the U.S. marketplace, the U.S. Government gained control through bailout purchases of stock from companies such as General Motors and Chrysler.

“Now we have the federal government taking over ownership or control of 51 percent of the American economy.”

Michele Bachmann

U.S. Representative – Minnesota (R)

Why is all of this important?

The Federal Government has shown itself to be anything but a passive owner. After taking control of General Motors, the Federal Government expelled the CEO of that company.1 Similarly, the Federal Government has limited and in some cases reduced the compensation packages of the senior executives of those companies that have received financial bailouts.2, 3 Thus, the government and not the private marketplace is now dictating these business rewards.

Why should this be a concern for any business other than those directly involved?

Activist government participation in the marketplace suggests that politicians may take other actions to the benefit of those organizations the government owns. In fact, they already have. Aggressive attacks against a competing organization as was evident by the recent General Motors ad campaign specifically targeting its besieged competitor, Toyota, and the extensive public Congressional hearings involving Toyota executives over its cars’ sudden acceleration problem. None of Toyota’s other competitors waged ad campaigns specifically targeting the automaker nor was the government as publicly vocal when poor maintenance practices at one of its Tennessee Valley Authority coal plants created one of the worst environmental disasters in U.S. history on December 22, 2008.4

This past activism suggests politicians may be willing to aggressively seek to dictate terms to suppliers of its organizations; not only in the name of good business practice but for political reasons supporting those in government. Combined this with the fact that the Federal government exerts significant direct ownership and control over approximately fifty-one percent of the U.S. market and it becomes evident that government officials will influence a vast number of businesses within the United States.

StrategyDriven Recommended Practices

- When at all possible, organizations should consider conducting their financial business with only those financial institutions not controlled by the U.S. Government, namely those organizations that have not received and do not appear to be at risk of receiving government bailout funds such that the government could the dictate the terms of their business operations. The goal is to minimize the organization’s exposure to government imposed stipulations associated with any borrowing that cannot be immediately paid back to avoid such stipulations.

- Businesses should seek to diversify their portfolios such that they are not overly reliant on the sale of products and/or services to controlled organizations. The goal is to provide flexibility such that the organization could shift of cease business relationships with those government controlled organizations should unacceptable terms be demanded.

- Businesses should factor in an additional risk if entering into the market of a government controlled organization. The goal is to account for the almost unlimited financial backing the Federal Government provides controlled organizations and its apparent willingness to use that funding to succeed in the marketplace.

- Minimize consumption of government controlled organizational products. The goal is to minimize the risk exposure the organization faces should politicians seek to exert influence through the restriction of needed products or services. Additionally, this practice recognizes that government employees are typically better compensated than their private sector counterparts.5

In principle, these actions are not to suggest an organization not do business with the Federal Government, government controlled organizations or within government controlled industries. Rather, we suggest an organization not become overly reliant on the business transactions conducted with such entities in order to be able to resist government dictates over the organization’s business operations. Such standards, quantity, and pricing dictates do come from other large organizations such as Wal-Mart. Unlike these cases, however, politically motivated government officials are more likely to build in additional social program requirements as a part of their dictates thereby inflating a company’s overall costs and subsequently jeopardizing its ability to provide market competitive products and services to its other buyers. The only way to avoid such government intrusion is to ensure sufficient diversification exists in the organization’s financial support, supply chain, and customer base.

Final Notes…

StrategyDriven is aware that several reputable organizations such as FactCheck.org and CBS have refuted the notion that the Federal Government controls fifty-one percent of the U.S. economy.6, 7 All of these organizations base their position on the fact that annual government spending accounts for approximately twenty percent of GDP. We respectfully disagree.

A purchaser, even a major purchaser, of an organization’s products and services exerts an indirect influential control over an organization. The greater the percentage of an organization’s output that is purchased, the greater the force of indirect influence that can be exerted. While the Federal Government’s twenty percent of GDP purchasing power gives it significant marketplace influence, this is not the type of direct control referenced in the assertion that the governments owns or controls fifty-one percent of the U.S. economy.

Direct control is very different. With direct control, an individual or institutes gains the authority to dictate the actions of the controlled business. Direct control comes from one of two means, ownership or regulation. Through its bailout purchase of a majority share of corporate stock, the U.S. Government has gained control over numerous businesses such as General Motors. Through the recently passed healthcare regulation, the government has dictated the product and service offerings and prices of numerous companies as well as the purchasing habits of all U.S. citizens within this space.

The government’s direct control over numerous businesses, begotten through ownership and regulatory policy, is why StrategyDriven believes the U.S. Government has control over fifty-one percent of the U.S. economy. The firing of GM’s CEO and caps and reductions of CEO salaries as cited above further illustrate the government’s use of its direct control over businesses that were once part of the private sector.

As always, StrategyDriven is not taking a position as to whether or not this degree of ownership and control by the Federal Government is appropriate. Instead, we simply highlight the consequences of these actions, namely that political forces will now intermingle with market forces to dictate the course of business. Given the extent of the government’s control over the previously private marketplace, this introduction of political drivers will have significant ramifications and warrants consideration and responsive action by business executives and managers.

Final Request…

The strength in our community grows with the additional insights brought by our expanding member base. Please consider rating us and sharing your perspectives regarding the StrategyDriven Editorial Perspective podcast on iTunes by clicking here. Sharing your thoughts improves our ranking and helps us attract new listeners which, in turn, helps us grow our community.

Thank you again for listening to the StrategyDriven Editorial Perspective podcast!

Sources

- “GM CEO resigns at Obama’s behest,” Mike Allen and Josh Gerstein, Politico, March 30, 2009, (http://www.politico.com/news/stories/0309/20625.html)

- “Few Fled Companies Constrained by Pay Limits,” Eric Dash, The New York Times, March 22, 2010, (http://www.nytimes.com/2010/03/23/business/23pay.html)

- “Stricter Pay Limits for Bailed Out Execs,” Associated Press, Washington D.C., March 23, 2010 (http://www.cbsnews.com/stories/2010/03/23/politics/main6326229.shtml)

- “Editorial: TVA’s silence on coal-ash spill ‘catastrophe’,” knoxnews.com, Scripps Interactive Newspapers Group, March 17, 2010 (http://www.knoxnews.com/news/2010/mar/17/tvas-silence-on-coal-ash-spill-catastrophe/)

- “For feds, more get 6-figure salaries,” Dennis Cauchon, USA Today, December 11, 2009 (http://www.usatoday.com/printedition/news/20091211/1afedpay11_st.art.htm)

- “Overstated Stats,” FactCheck.org, April 1, 2010 (http://factcheck.org/2010/04/overstated-stats-on-sunday/)

- “Reality Check: Bachmann On Health Care Reform,” CBS, March 30, 2010 (http://wcco.com/realitycheck/reality.check.michele.2.1600321.html)

For an up-to-date listing of U.S. Government bailouts, see: “Eye on the Bailout – Bailout Recipients,” Pro Publica (http://bailout.propublica.org/main/list/index).

Podcast: Play in new window | Download (Duration: 11:30 — 15.8MB)

Subscribe: RSS