4 Golden Rules For Would-Be Investors

There are risks to all investment types, whether you’re considering stock, shares, bonds, real estate, or the trending cryptocurrencies to trade this year.

There are a few golden rules that every investor should follow. We list some of them below and by adhering to them, you will reduce risk and improve your chances of reaping a financial reward.

#1: Have a goal in mind

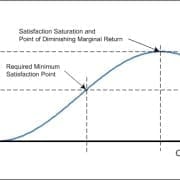

Many investors have one simple goal: to be as rich as possible. This isn’t necessarily a bad thing but it is a bit abstract. Without a financial figure in mind or a projected timeline, they could invest forevermore and increase the risk of losing money.

When investing, consider your financial goals. it might be an x amount of money for retirement or enough money to put your children through college. When you have attained these goals, you can withdraw this money and put it into your savings fund. If you don’t withdraw it, there is the chance that you will lose some or all of it if a later investment works out badly.

#2: Don’t put all of your eggs in one basket

One of the biggest investment mistakes you can make is putting all of your investment money into one type of asset. If the asset performs badly, you could make significant losses and this would scupper your chance of achieving your financial goals.

It is wiser to diversity your portfolio as this way, you still have the opportunity to make a profit from something, even if you suffer financial losses elsewhere.

#3: Don’t invest in something you don’t understand

You don’t need to be an investment expert but a little bit of knowledge will still carry you a long way. If you were to invest in stocks without knowing about much about the highs and lows of the stock market, for example, you could make a bad decision when choosing where to invest your money. The same applies to other forms of investments.

To learn more, read articles online and take time out to read books written by expert investors. Use trading simulators so you can get a handle on the basics without the need for real money. And if you know any experienced investors, talk to them and ask them all the questions you need before you make any type of investment yourself. By gaining knowledge, you are less likely to do something you might later regret.

#4: Don’t invest what you can’t afford

Before you invest, budget your finances. You still need money for your household bills, family needs, and all of your other expected expenses. If you invest without budgeting, you could lose money that you need elsewhere and this could leave you in a dire financial situation.

Don’t only factor in your daily expenses, however. Leave room for an emergency fund too as it’s wise to put money into that, as you may be faced with unexpected expenses. After factoring in this and all of your other living costs, you will then know how much you have leftover for investing purposes.

Finally

These are just some of the rules you should adhere to. However, there are more to add to this list, so continue your research online and then remind yourself of these rules whenever you decide to start investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!